Schwab Intelligent Portfolios is a smart investment service provided by Charles Schwab one of the most trusted financial companies in the USA. Many people call it a robo-advisor because it uses advanced technology to help manage your money and invest it based on your goals. You do not need to be a finance expert to use it. The system automatically builds and manages your investment portfolio.

Who Can Use Schwab Intelligent Portfolios?

The great thing about Charles Schwab Intelligent Portfolios is that it is designed for almost anyone who wants to start investing regardless of experience. Whether you are a complete beginner or someone who already knows a little about investing, this service can help you manage your money better.

Note: Schwab also offers Schwab Intelligent Portfolios Premium, which comes with more personalized financial planning and unlimited guidance from a human advisor, but that has an extra cost.

Features and Benefits

Schwab Intelligent Portfolios comes with several powerful features designed to make investing easy stress-free and effective. Let’s break them down in simple terms:

Fully Automated Investing

Once you set your goals and answer a few questions about your risk tolerance the system takes care of everything picking investments managing them and adjusting your portfolio automatically as markets change.

No Advisory Fees

One of the biggest advantages is that Schwab does not charge advisory or management fees for its basic Intelligent Portfolios service. You only pay the fees built into the investment products but Schwab itself doesn’t charge extra for portfolio management.

Diversified Investment Portfolios

Your money isn’t placed into just one stock or asset. Schwab spreads your investments across different areas like stocks, bonds, real estate, and commodities to reduce risk and aim for steady growth.

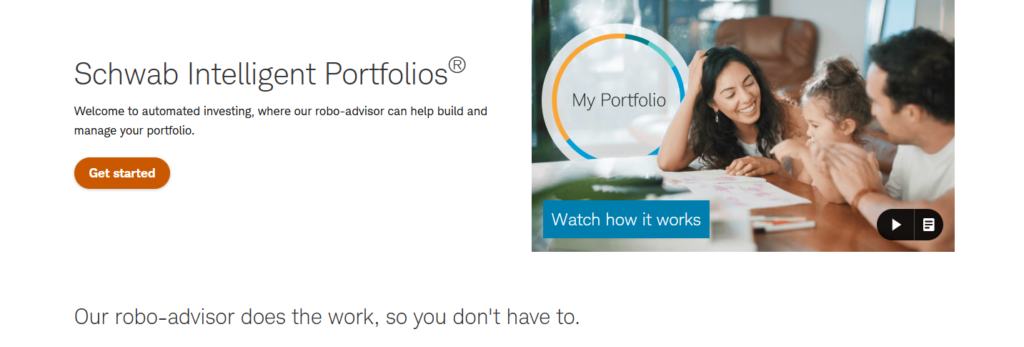

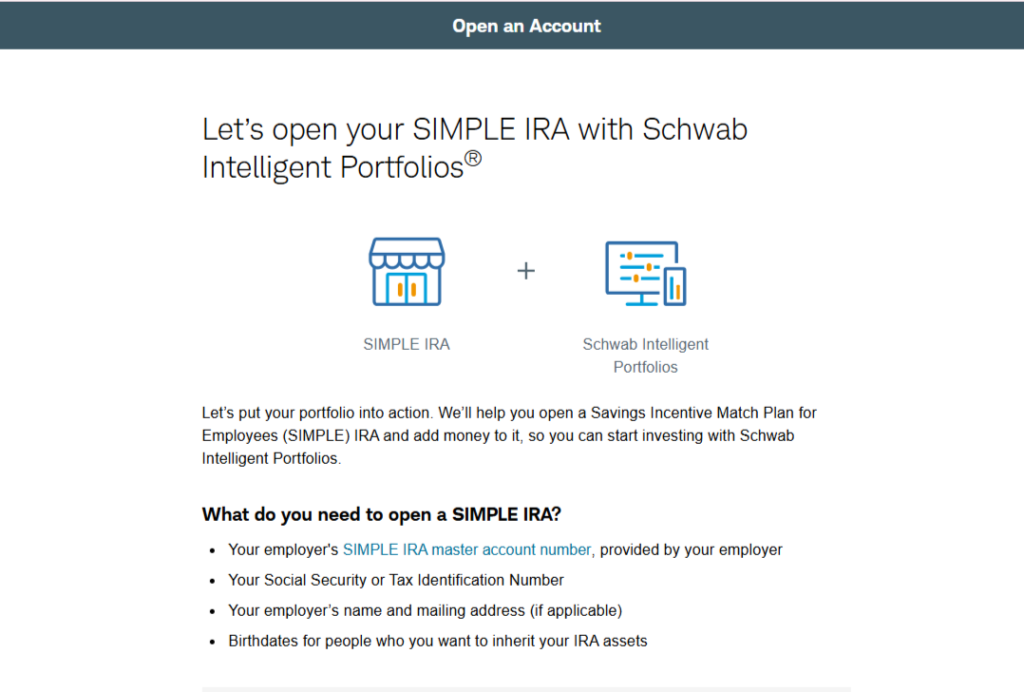

How to Open a Schwab Intelligent Portfolios Account

Starting your investment journey with Schwab Intelligent Portfolios is surprisingly easy. You don’t need to visit a branch or speak to an advisor unless you want to. Everything can be done online.

- Go to the official Schwab website: www.schwab.com/intelligent-portfolios

- Click on Get Started

- Answer a series of simple questions about your financial goals, investment preferences, and risk tolerance

- Review the recommended investment portfolio tailored to your answers

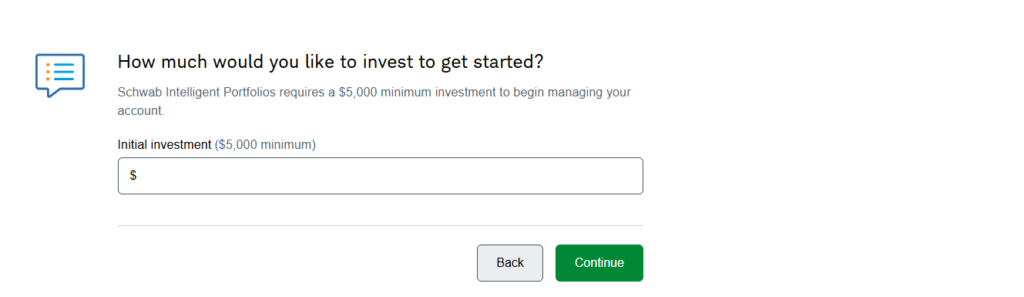

- Open your account online and deposit at least $5,000 to get started

- Sit back and let Schwab’s system handle the investment process for you

Cost & Fees

Basic Schwab Intelligent Portfolios:

One of the biggest reasons people like Schwab Intelligent Portfolios is the low cost. Let’s break it down clearly:

- No advisory or management fees

- You only pay the underlying expense ratios of the ETFs in your portfolio (average around 0.06% to 0.20% annually)

- There’s also a cash allocation in your portfolio, which Schwab uses to help manage risks

Schwab Intelligent Portfolios Premium:

- $300 one-time planning fee

- $30 per month ongoing advisory fee

- Includes unlimited human advisor support and more detailed financial planning

How Much Can You Earn with Schwab Intelligent Portfolios?

This is the most common question — how much profit can you make? While no investment can guarantee returns, here’s what you should know:

- Your potential earnings depend on your risk tolerance and market conditions

- Historically, diversified portfolios with more stocks have higher returns but also higher risk

- Conservative portfolios aim for steady growth with less risk but lower returns

FAQs

Is Schwab Intelligent Portfolios safe to use?

Yes, your money is held with Charles Schwab a trusted financial institution regulated in the USA. Your investments are protected and the system is designed with strong security features.

Can I withdraw my money anytime?

Yes, your funds are accessible. You can withdraw or transfer your money when needed but keep in mind that long-term investing usually offers the best growth potential.

Is Schwab Intelligent Portfolios good for retirement savings?

Yes, it’s an excellent option for people saving for retirement, thanks to automated management, diversification, and tax efficiency.

How is Schwab different from other robo-advisors?

Schwab offers no advisory fees, uses a broad range of investment options, includes automatic rebalancing, and provides strong customer support — all backed by a respected brand.