If you are looking for a safe, easy, and trusted place to grow your money, Charles Schwab investing is one of the best options for beginners. With low fees, expert tools, and simple account options, Schwab helps you start your investment journey the smart way. In this guide, we will explain everything you need to know about Charles Schwab investing – from how to open an account to what types of investments are available and how to grow your money wisely.

How to Open a Charles Schwab Investing Account

Starting your Charles Schwab investing journey is simple. Follow these steps:

- Go to schwab.com and click on Open an Account.

- Pick the type of account you want. If you are new a brokerage account or Roth IRA is best.

- Provide basic personal info like your name address job status and Social Security number.

- Transfer money from your bank account to your new Schwab account. You can start with $0.

- Log in search for stocks or funds and make your first investment.

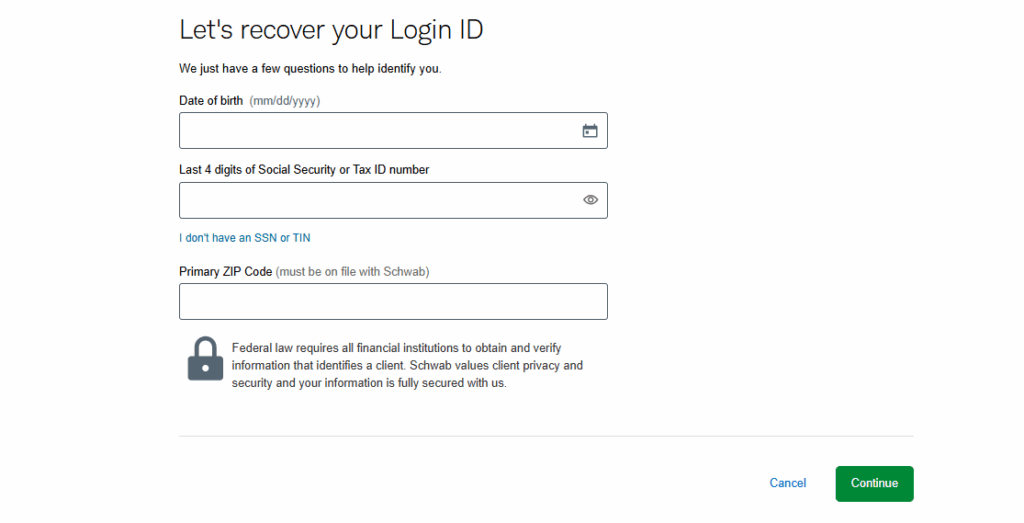

Types of Accounts You Can Open

Charles Schwab investing offers different accounts based on your goals:

1. Individual Brokerage Account

Best for beginners who want to invest in stocks, ETFs, and mutual funds.

2. Roth IRA

Ideal for long-term retirement savings. You invest money after taxes and enjoy tax-free withdrawals later.

3. Traditional IRA

Great for saving on taxes today and building wealth for retirement.

4. Custodial Accounts

For parents who want to save for their children’s future.

5. 401(k) Rollover

Easily move your old job’s 401(k) into Schwab and take full control of your retirement plan.

What Can You Invest in with Charles Schwab?

Charles Schwab investing gives access to many options for all types of investors:

- Buy shares of companies like Apple, Google, and Tesla.

- These are bundles of stocks. They are low-cost and perfect for beginners.

- Great for long-term investing with less risk.

- Lower-risk investments that offer regular income.

- Invest in real estate without buying property.

- Advanced investing strategy – not recommended for beginners, but available if you learn later.

How Much Money Do You Need to Start?

One of the best things about Charles Schwab investing is that you do not need a lot of money to begin. There is:

- $0 account minimum

- Many ETFs with no minimum investment

- Stocks can be bought in fractions with Schwab Stock Slices (you can invest with as little as $5)

What is Schwab Intelligent Portfolios?

If you do not want to pick investments yourself, try Schwab Intelligent Portfolios a free robo-advisor that creates a portfolio for you based on your risk level and goals. It is a smart way to start investing without needing to choose individual stocks.

Tips for Beginners Using Charles Schwab

- Even $5 can begin your journey.

- Do not put all your money in one stock.

- Learn while you invest.

- Invest regularly every month.

- Do not try to get rich overnight.